How Much Does It Cost to Start an LLC?

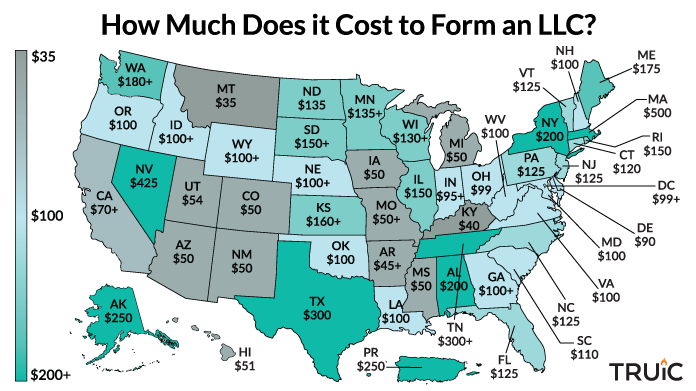

The main cost of forming a limited liability company (LLC) is the state filing fee. This fee ranges between $40 and $500, depending on your state.

There are two options for forming your LLC:

- You can hire a professional LLC formation service to set up your LLC (for an additional small fee).

- Or, you can use our free Form an LLC guide to do it yourself.

We reccomend you save yourself the hassle and use a professional service to form your LLC:

Cost to Form an LLC

The main cost of forming an LLC is the fee to file your LLC's articles of organization with the Secretary of State. This fee ranges from $40-$500, depending on the state.

Other LLCs costs might include:

- Business licensing and permit fees

- Publication fees in Arizona, Nebraska, and New York

- Optional LLC name reservation fees (required in Alabama)

- Optional fictitious name fee (also known as DBA name)

Looking to save money? Visit our How to Save Money Forming Your LLC page.

State Filing Fee

The fee to register an LLC with the Secretary of State ranges between $40 and $500, depending on your state.

You can form an LLC yourself with our free Form an LLC guides and pay only the state registration fee:

- Alabama LLC

- Alaska LLC

- Arizona LLC

- Arkansas LLC

- California LLC

- Colorado LLC

- Connecticut LLC

- Delaware LLC

- Florida LLC

- Georgia LLC

- Hawaii LLC

- Idaho LLC

- Illinois LLC

- Indiana LLC

- Iowa LLC

- Kansas LLC

- Kentucky LLC

- Louisiana LLC

- Maine LLC

- Maryland LLC

- Massachusetts LLC

- Michigan LLC

- Minnesota LLC

- Mississippi LLC

- Missouri LLC

- Montana LLC

- Nebraska LLC

- Nevada LLC

- New Hampshire LLC

- New Jersey LLC

- New Mexico LLC

- New York LLC

- North Carolina LLC

- North Dakota LLC

- Ohio LLC

- Oklahoma LLC

- Oregon LLC

- Pennsylvania LLC

- Rhode Island LLC

- South Carolina LLC

- South Dakota LLC

- Tennessee LLC

- Texas LLC

- Utah LLC

- Vermont LLC

- Virginia LLC

- Washington LLC

- Washington D.C. LLC

- West Virginia LLC

- Wisconsin LLC

- Wyoming LLC

Other LLC Costs and Fees

Business Licenses and Permits

Depending on your industry and geographical location, your business might need federal, state, and local permits/licenses to legally operate. This is true whether you form an LLC or any other type of business structure.

Recommended: Visit our state-by-state How to Get a Business License guide.

Publication Fees

Some states (Arizona, Nebraska, and New York) require your new LLCs to publish a statement of formation in a local newspaper.

Publishing costs can be between $40 and $2000, depending on your state’s requirements.

Name Reservation Fee

If you’re forming an LLC in Alabama, you will also need to reserve your LLC’s name for a fee of $10-$28. Reserving a name is optional for all other States.

Fictitious Name Fee

A fictitious name isn’t required for LLCs. After you form your LLC, you might want to create a fictitious name to create separate brands under your main LLC. A fictitious name is usually referred to as a DBA or "doing business as" name.

Where Should I Form My LLC?

You should always form your LLC in the state where you plan to conduct business. Otherwise, you may end up with additional unwanted costs and paperwork.

To learn more, visit our Best State to Form an LLC guide.

Recommended: Learn more about LLC formation services in our best LLC services review.

Cost to Form an LLC in Every State

The table below provides the filing fees in each state as well as any annual expenses.

Recommended: Select the state name for a more detailed report.

| Setup Costs | Ongoing Costs | |

| Alabama | $200+ | $100+ Annually & Business Privilege License |

| Alaska | $250 | $200 Biennially & $50 Annual Business License |

| Arizona | $50 & Publishing Requirement | No Annual Fee |

| Arkansas | $45+ | $150 Annual Franchise Tax |

| California | $70+ | $20 Biennially, $800 Annual Tax, & Annual LLC Fee |

| Colorado | $50 | $10 Annually |

| Connecticut | $120 | $20 Annually |

| Delaware | $90 | $300 Annual Franchise Tax |

| Florida | $125 | $138.75 Annually |

| Georgia | $100+ | $50 Annually |

| Hawaii | $51 | $12.50–$15 Annually |

| Idaho | $100+ | No Annual Fee |

| Illinois | $150 | $75 Annually |

| Indiana | $95+ | $50 Biennially |

| Iowa | $50 | $30–$45 Biennially |

| Kansas | $160+ | $50–$55 Annually |

| Kentucky | $40 | $15 Annually |

| Louisiana | $100 | $30 Annually |

| Maine | $175 | $85 Annually |

| Maryland | $100 | $300 Annually |

| Massachusetts | $500 | $500 Annually |

| Michigan | $50 | $25 Annually |

| Minnesota | $155+ | Annual Partnership Tax |

| Mississippi | $50 | No Annual Fee |

| Missouri | $50+ | No Annual Fee |

| Montana | $35 | $20 Annually |

| Nebraska | $100+ & Publishing Requirement | $10 Annually |

| Nevada | $425 | $150 Annual List & $200 Annual Business License |

| New Hampshire | $100 | $100 Annually, Annual Business Profits Tax, & Annual Business Enterprise Tax |

| New Jersey | $125 | $50 Annually |

| New Mexico | $50 | No Annual Fee |

| New York | $200 & Publishing Requirement | $9 Biennially & Annual Filing Fee |

| North Carolina | $125 | $200 Annually |

| North Dakota | $135 | $50 Annually |

| Ohio | $99 | Annual Commercial Activity Tax |

| Oklahoma | $100 | $25 Annually |

| Oregon | $100 | $100 Annually |

| Pennsylvania | $125 | No Annual Fee |

| Rhode Island | $150 | $50 Annually |

| South Carolina | $110 | No Annual Fee |

| South Dakota | $150+ | $50 Annually |

| Tennessee | $300+ | $50 per Member Annually & Annual Franchise/Excise Taxes |

| Texas | $300 | Annual Franchise Tax |

| Utah | $54 | $13 Annually |

| Vermont | $125 | $35 Annually |

| Virginia | $100 | $50 Annually |

| Washington | $180+ | $60 Annually |

| West Virginia | $100 | $25 Annually |

| Wisconsin | $130+ | $25 Annually |

| Wyoming | $100+ | $50 or 0.02% Value of Assets Annually |

| Washington D.C. | $99+ | $300–$400 Biennially |

Ongoing Maintenance Costs

In some states, LLCs will be required to pay ongoing maintenance costs and taxes such as:

- Franchise Tax

- Annual Report Fees

Franchise Tax

Some states levy a yearly tax on LLC's (often called a franchise tax). This is usually a flat tax, but can also vary according to your LLC's annual earnings in certain states.

Annual/Biennial Report

Most states require LLCs to submit an annual or biennial report which includes updating the name, address, and ownership of the LLC. The report fee varies state by state.

Visit our state-specific LLC Annual Report guides to learn more about annual fees and franchise tax.

How to Register an LLC Yourself

Forming an LLC yourself is easy. Our state-by-state LLC formation guides simplify the process into five basic steps.

Recommended: If you already have a business that is running as a sole proprietorship, visit our How to Change from a Sole Proprietorship to LLC page.

Five Basic Steps to Start an LLC

Step 1: Name Your LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Step 5: Get an EIN

Step 1: Name Your LLC

When you name your LLC, you’ll need to choose a name that:

- Is available for use in your state

- Meets your state’s naming requirements

- Is available as a web domain

Recommended: Visit our Form an LLC guide for detailed naming rules and instructions for registering a business name in your state.

Not sure what to name your business? Check out our How to Name a Business guide and free LLC Name Generator.

Step 2: Choose a Registered Agent

LLCs must appoint a registered agent in most states. A registered agent primarily acts as your LLC’s main point of contact with the state. But most importantly, they are responsible for accepting service of process in the event your business is sued.

A registered agent must:

- Be at least 18 years or older

- Have a physical address in the LLCs state

- Available during normal business hours to accept service of process

TIP: Many LLC formation services include a free year of registered agent service when you form your LLC. Northwest charges $29 (plus state fees) for LLC formation and includes a free year of registered agent services.

Step 3: File the Articles of Organization

The articles of organization, also known as the certificate of formation or certificate of organization, is a document that is filed with your state to form an LLC.

The fee to file the articles of organization varies from $40-$500, depending on your state.

Step 4: Create an Operating Agreement

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our LLC operating agreement guide.

Step 5: Get an EIN

What is an EIN? An EIN or Employer Identification Number is a nine-digit number issued by the Internal Revenue System (IRS) to identify a business for tax reporting purposes. An EIN is essentially a Social Security number (SSN) for the company.

Why do I need an EIN? An EIN number is required for the following:

- To open a business bank account

- For Federal and State tax purposes

- To hire employees

Free EIN: You can get an EIN from the IRS (free of charge) after forming your business. This can be done online on the IRS website or by mail.

Hiring an LLC Service Provider

Should you hire a professional LLC formation company? LLC service providers make the process of setting up your business easier, but they aren't required.

Recommended: Visit our Form an LLC guide and find easy instructions for starting an LLC yourself and only pay the state fee.

Basic LLC Formation Service Package: $29 - $79

Online services like Northwest Registered Agent ($29 + State Fee) and LegalZoom ($79 + State Fee) will take care of the LLC filing process on your behalf for a fraction of the cost of a business attorney.

In addition to filing your certificate of formation, LLC formation providers offer other services. LLC formation services will also:

- Create your LLC operating agreement

- Register for your LLCs Employee Identification Number (EIN) with the IRS

- Act as your registered agent, often for free for the first year

Operating Agreement: $40-$99

An operating agreement is a governing document that outlines the ownership and management structure of an LLC.

Purchasing a custom operating agreement from an online formation service is an easy way to ensure you’ll have a thorough and legally-binding document governing your new LLC.

EIN Registration: $60-$70

After forming your LLC, you’ll need to get an EIN (or Employer Identification Number)—essentially a Social Security number for your business. If you’d prefer not to apply for your EIN directly through the IRS, you can delegate this task to your formation provider for an extra fee.

Registered Agent Service: $0-$125 per year

You'll need to designate a registered agent for your LLC when you complete the certificate of formation.

A registered agent is an individual or business entity responsible for receiving and processing legal documents and service of process on behalf of your business.

Many people choose to appoint a professional registered agent for privacy, convenience, and discretion.

Learn more about hiring a registered agent in our Should I Use a Registered Agent Service guide.

If you decide that hiring a registered agent is right for your LLC, we recommend Northwest Registered Agent. Their registered agent services are free for the first year and $125 every following year.

Business License Research Service: $99

If your LLC requires several federal, state, and local permits or licenses in order to legally operate, you might want to consider hiring a professional business license research service.

If you’re looking to maximize your time in the early phases of your business, we recommend checking out Incfile's $99 business license research package.

Recommended: Visit our state-by-state How to Get a Business License guide.

Thinking about using an LLC formation service? Check out our Best LLC Services review.

LLC Cost FAQ

Do you have to pay for an LLC every year?

In some states, there is an annual franchise tax and/or annual report fee. Visit our LLC annual report guide and choose your state to learn exactly what ongoing fees might be required in your state.

Is an LLC really necessary?

An LLC provides limited liability protection. This means an LLC protects your personal assets in the event of a business loss such as a lawsuit or unpaid debt.

We recommend any small business that carries even the smallest amount of risk or liability, to form an LLC. Learn more in our Should I Start an LLC guide.

What is the cheapest way to get an LLC?

You can save money on getting an LLC by:

- Completing the formation process yourself

- Making your own operating agreement

- Being your own registered agent, and getting your own EIN.

Check out our How to Save Money Forming Your LLC guide to learn more.

Can I pay myself a salary from my LLC?

You can pay yourself a salary from your LLC but it would be called a draw or distribution if your LLC is taxed in the default way by the IRS.

Visit our How Do I Pay Myself From My LLC guide to learn more.

Is an S corp better than an LLC?

An S corporation (S corp) is an IRS tax status, not a type of business entity. An LLC can be taxed in the default way or as an S corp. For some businesses, being taxed as an S corp can make lots of sense.

Check out our S Corp vs LLC guide to learn if S corp status is right for your business.

Is LegalZoom worth it for an LLC?

LegalZoom creates more LLCs than any other provider. They also have mediocre reviews and charge more than any other service provider. We think there are better LLC formation services out there.

Check out our Best LLC Services review to learn more.

What’s better sole proprietorship or LLC?

A sole proprietorship is only good for businesses that carry very low risk of liability because sole proprietorships don’t offer any liability protection.

Learn more in our sole proprietorship vs LLC guide.

What all can you do with an LLC?

There are many advantages to starting an LLC. Visit our guide to learn more about the benefits of an LLC.

Does having an LLC help with taxes?

An LLC can help with taxes if your business needs more options. An LLC can be taxed via pass-through taxation, as an S corp, or as a C corp.

Visit our Choosing a Business Structure guide to learn what type of business structure would offer the most tax benefits to your unique business.

Is it better to have an LLC or corporation?

Both corporations and LLCs offer limited liability protection.

LLCs are easier to set up and run. LLCs also cost less. Corporations are useful for small businesses and startups that need to rely on outside investors.

Learn more in our LLC vs Corporation guide.

Do LLCs need insurance?

Yes. LLCs can protect a business owner's personal assets but you'll need small business insurance to protect the business's assets.

Read our Best Small Business Insurance for LLCs review to learn more.