How is an LLC Taxed?

A limited liability company (LLC) doesn't pay taxes at the business level. Instead, LLC income passes through to the member's personal income tax return.

This allows LLCs to avoid the double taxation of a corporation while still having the benefit of limited liability protection.

Learn the basics in our How is an LLC Taxed guide below.

Recommendation: One consultation with 1-800 Accountant could save your business thousands in taxes. Schedule Your Free Call.

LLC Tax Basics

By default, LLCs are treated as a pass-through entity for federal income tax purposes. This means LLCs don't pay federal income taxes at the business level. LLC income passes through to members' personal income tax returns based on their percentage of ownership as it's laid out in the LLC operating agreement. The income is then subject to individual income tax rates.

Payments made to members are called distributions or draws. Distributions are subject to self-employment taxes. For some LLCs, it might make sense to elect S corporation tax status to reduce self-employment taxes.

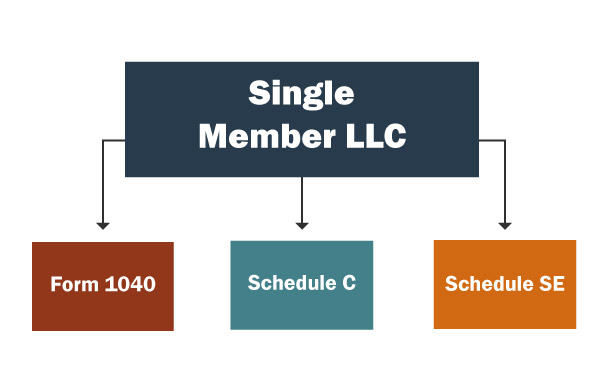

Single-Member LLC Taxes

Single-member LLCs are taxed by the IRS as “Disregarded Entities.” This just means the IRS ignores the structure of your business (i.e., the fact that it's a single-member LLC) and taxes you like it does a sole proprietorship. The LLC’s income is reported on your personal tax return at the end of the year.

With your LLC income, you can pay yourself with a distribution. You will have to pay self-employment taxes on your distribution but, because you already paid income tax on the LLC’s total profits, you do not have to pay income tax on the distribution. This process is explained more in our How Do I Pay Myself From My LLC guide.

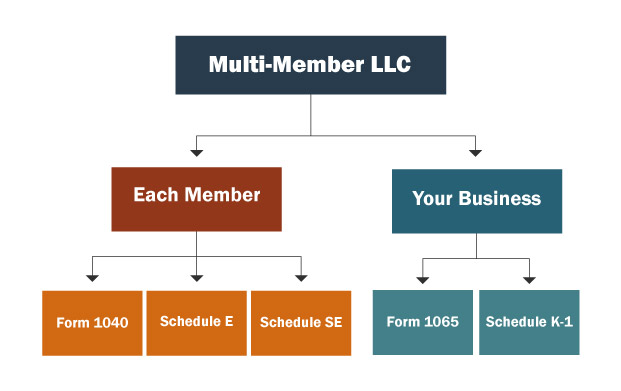

Multi-Member LLC Taxes

A multi-member LLC is typically taxed as a partnership by the IRS. This means that LLCs don't pay federal income taxes to the IRS and all profits are passed through to the members of the LLC as per the partnership operating agreement. The members of the LLC then pay the taxes to the IRS on their individual tax returns.

Like single-member LLCs, each owner in a multi-member LLC can take a distribution from their share of the LLC’s profits. This process is explained more in our How Do I Pay Myself From My LLC guide.

Recommended: 1800 Accountant offers easy to use accounting software and excellent customer support to easily manage your finances and file your taxes.

Other LLC Tax Structures: S Corp and C Corp

For most people starting an LLC, the default tax structures—“disregarded entity” for single-member LLCs or “partnership” for multi-member LLCs—are probably the most appropriate. These are the standard tax structures for limited liability companies and do not require a special election when forming.

However, under certain circumstances, both single-member LLCs and multi-member LLCs can also elect to be taxed like a corporation. The two corporate tax classifications are C corporation (C corp) and S Corporation (S corp).

A C corporation pays taxes on gross income minus all operating expenses. They then distribute profits to shareholders, and shareholders pay income tax on the dividends. This is also known as "double-taxation.”

An S corporation allows the member(s) of a company to save on taxes. It is a tax classification with specific rules that can be beneficial to your company if your business earnings are significant. However, before making a decision, it’s important to understand the basics of an S corp and what changes may be in store for your business if you decide to elect S corp status.

Selecting these tax structures can be done when you apply for an EIN (Employer Identification Number) for your LLC or at a later time.

Featured Articles

View All

LLC Federal Income Taxes

Regardless of which tax designation you elect for your LLC, you still have to file with the IRS.

All owners will have to fill out Form 1040—your individual income tax return—and its appropriate schedules:

- Schedule C: The form for reporting income specifically from your business.

- Schedule SE: The form for filing and paying your self-employment taxes.

- Schedule E: The form for reporting any income from rental properties and other investments.

Multi-member LLCs and special entities will need to file more than that. Partnerships, in addition to Form 1040, must also file the following:

- Form 1065: The form used to report your business’s gains and losses.

- Schedule K-1: The form for reporting your share of the profits as an individual owner.

Check out our guide to filing federal LLC taxes to see a full list of necessary forms for both single-member LLCs and multi-member LLCs.

LLC State Income Taxes

Because LLCs are typically “pass-through” entities, they do not have to pay separate state taxes. That is, the individual members pay state taxes; not the LLC itself.

Here are some of the common forms of state tax:

- Franchise Tax: Some states require this tax, which is based on how much an LLC earns per year.

- Sales and Use Tax: If you sell physical products, consumers pay this tax to you and you pay this tax to your respective state or local governments.

- Gross Receipts Tax: While similar to a sales tax, a gross receipts tax is paid by the seller rather than the buyer.

- Withholding Tax: This is income that is withheld from employee paychecks and paid to the government.

- Unemployment Insurance (UI) Tax: UI is used for unemployment benefits. Tax rates are set by state law.

You can find out more in our detailed guide to state LLC taxes. You can also read our How to Form an LLC guides to learn more about LLC taxes by state.

LLC Business Expenses

As a business, you are able to deduct certain expenses from your taxes. The IRS says that a deductible business expense is both “ordinary and necessary.” In other words, your business can write off any expenses that help your business succeed.

Tax-deductible expenses can include a variety of purchases; these are just a few common examples:

- Office supplies

- Rent and general maintenance

- Licenses and permits

- Advertising

- Insurance

Some expenses, such as travel and entertainment-related purchases, are harder to deduct. These categories have spending limits, additional terms, or must be capitalized.

Of course, expenses are only deductible if they are “appropriate.” You might think a rooftop Jacuzzi is important for maintaining your business, but the IRS probably won’t agree with you unless you’re a Jacuzzi-selling business.

You can check out our business expense guide for a complete list of basic and complex deductions.

LLC Bookkeeping and Accounting

It’s important to make sure your books are in order to protect your corporate veil.

Separate your personal matters from your business expenses as much as possible. You can do this by:

- Opening a separate business bank account.

- Obtaining a business credit card for work-related purchases.

- Creating a solid bookkeeping system - A high-quality accounting program can help keep track of your expenses and make the process simple and relatively pain-free. You can also hire an accountant.

Check out our Guide to Small Business Bookkeeping to learn more.

Recommended: A business accountant service can help you avoid overpaying taxes, manage bookkeeping, issue payroll, and more. Schedule a consultation with a business accountant today to find out how much time and money your business could save.

LLC Taxes FAQ

What tax classification is an LLC?

An LLC is classified by default as either a disregarded entity (for single-member LLCs) or a partnership (multi-member LLCs). However, LLCs can elect to be classified as a C corp or S corp.

Do I file my LLC and personal taxes together?

It depends on your structure.

- Single-member LLCs taxed as a disregarded entity file their business income on Schedule C, which is submitted with their individual tax return (Form 1040).

- Multi-member LLCs taxed as a partnership file the total business’s income on Form 1065, and each partner reports their individual profits on Schedule K-1 as well as their individual tax return.

- LLCs that choose to be taxed as a C corp file Form 1120 and the owners do NOT report business income on their individual tax return.

- LLCs that choose to be taxed as an S corp file Form 1120S and the owners report their individual share of income on Schedule K-1 as well as their individual tax return.

Is owning an LLC considered self-employed?

Yes. LLCs are taxed as pass-through entities just like if you were an independent contractor or sole proprietor.

If taxed as a disregarded entity or a partnership, LLC owners must make quarterly income tax payments to the IRS (and state, if applicable) as well as list their self-employment tax amount on their personal tax returns.

Do I have to pay taxes on an LLC that made no money?

LLCs with no business activity that are taxed as either a disregarded entity or a partnership do not have to file their LLC income.

Single-member LLCs with no business activity do not have to file their LLC income on Schedule C, but may have to report any other non-LLC self-employment income on Schedule C.

Multi-member LLCs with no business activity do not have to file a partnership return unless the LLC wishes to claim any expenses.

LLCs that elect to be taxed as a corporation will need to submit an annual corporate tax return regardless of business activity.

Can I file my own LLC taxes?

Yes. You can file your own business tax returns for your business, or you can use tax preparation software.

Is an LLC better for taxes?

An LLC has the option to choose between tax structures, allowing them to pick the one that benefits them the most.

LLCs benefit from pass-through taxation by default, meaning that the LLC’s profits pass directly to the members and are reported on the members’ tax returns.

However, LLCs can elect to be taxed as a corporation to avoid self-employment tax, receive potential tax deductions, and look overall more appealing to investors.

How do I convert my LLC to an S corp?

You can convert your LLC to an S corporation (S corp) by completing Form 2553 and filing it with the Internal Revenue Service.

To learn more about whether electing the S corp tax classification is right for your LLC, visit our LLC vs S Corp guide.

If the IRS treats my single-member LLC as a disregarded entity, do I still get the benefits of being an LLC?

Yes. Even though the IRS ignores the LLC structure when it comes to taxation, don’t worry—you still get the benefits of personal asset protection and deduction of business expenses.

To ensure you get these benefits, you should conduct your business in a formal way. These basic rules are outlined in our LLC corporate veil article.