Tax Write-Offs for Your LLC: Maximize Your Deductions

When you file taxes for your limited liability company (LLC) you want to ensure that you are writing off every legitimate business expense.

Our guide will help you discover uncommon or often missed tax write-offs for your LLC and also explain the difference between tax deductions and tax credits to help you save even more money.

This guide was written in consultation with top small business accountants and contains examples and relevant percentages to help your LLC maximize deductions.

Recommended: One consultation with 1-800 Accountant could save your business thousands in taxes. Schedule Your Free Call.

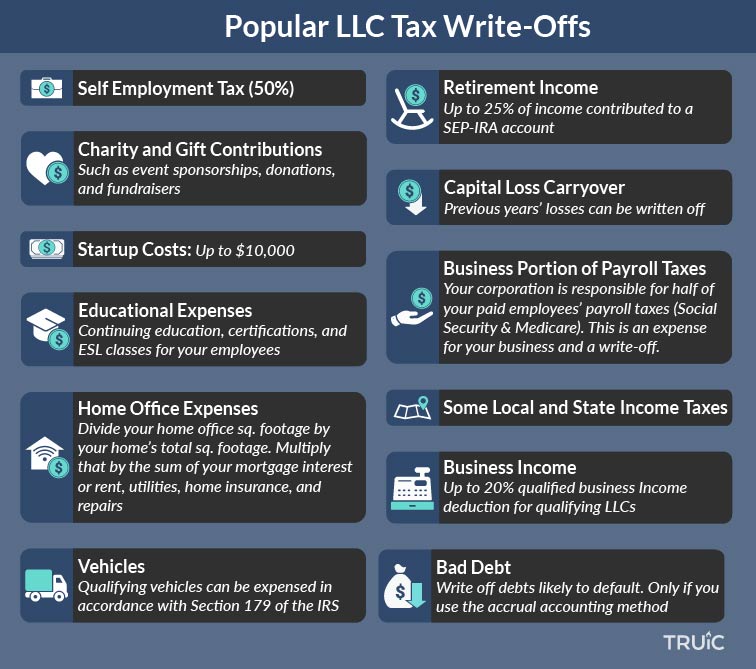

Popular LLC Tax Write-Offs

Tax write-offs are actual expenses incurred by your business that are the cost of carrying on a trade or business. These expenses are usually deductible if the business operates to make a profit.

According to the Internal Revenue Service,

“To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your trade or business.”

IRS Reference: Publication 535

LLCs don't have to pay separate business taxes on their company. Instead, the profits and losses "pass through" to each member's personal tax return — either by attaching Schedule C to Form 1040 (single-member LLCs) or by reporting their Schedule K-1 amounts on their personal return (multi-member LLCs).

According to Keeper, an online expense tracker for freelancers, the average US contractor overpays on their taxes by 21%. You want to make sure that every legitimate expense you undergo to run your business is written off to minimize your tax burden.

1-800 Accountant offers consultations with CPAs and tax professionals so you can maximize your deductions using their DIY accounting software or have them handle your bookkeeping so you can focus on your business.

If you prefer to do your own taxes, here are some of the more overlooked write-offs:

The average freelancer/contractor overpays on their taxes by about 21%. Get a dedicated business bank account with a tax optimizer to help you save money at tax time. We recommend Lili.

Tax Deductions vs. Tax Credits

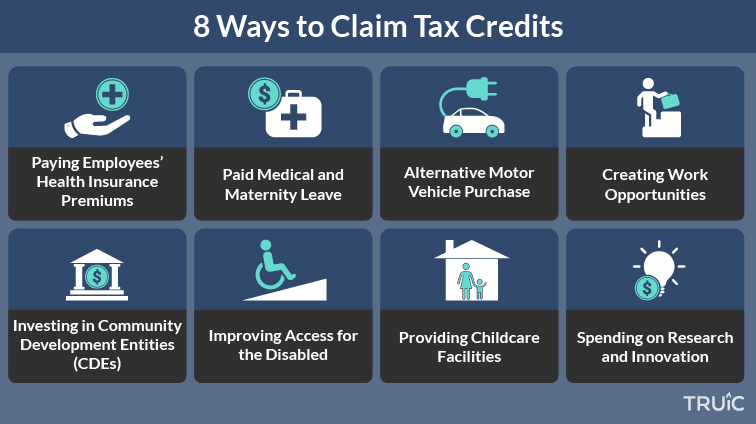

Tax deductions, or write-offs, reduce your taxable income but tax credits reduce your tax burden, dollar for dollar. You are able to claim both deductions and credits on your tax return, but you cannot claim the same expense, both as a deduction and as a credit.

For example, if you purchase health insurance premiums for your employees that can be written off as an expense on your Schedule C, you can also claim a tax credit for that expense. In most cases, if you can claim a tax credit for an expense, it is best to go with the credit.

Here is an example to illustrate the difference between deductions and credits:

Let’s say you own a coffee shop, incorporated as a Limited Liability Company (LLC), and, for the year 2021, your business earned $100,000 in revenue. The cost of running your business was $30,000, which you took in the form of tax deductions.

Now your taxable income is $70,000 instead of the full $100,000. As LLCs have pass-through taxation, you will end up paying taxes on this income based on your personal income tax bracket. Your estimated tax would be $17,500 (with a tax rate of 25%).

On the same token, if you claimed $0 in deductions, then your taxable income is $100,000, and your tax burden would be $25,000 with a 25% tax rate. If you claimed a tax credit of $30,000, you would pay $0 in taxes and have $5,000 in credits to carry over to next year if it is a non-refundable credit and has a carryover, or you can get $5,000 refunded if it is a refundable tax credit.

Here’s a visual representation:

Tax Deductions vs. Tax Credits

|

Deductions |

Credits |

|

|

Annual Income |

$100,000 |

$100,000 |

|

Less Write-Offs |

($30,000) |

$0 |

|

Taxable Income |

$70,000 |

$100,000 |

|

Tax Rate |

25% |

25% |

|

Tax Burden |

$17,500 |

$25,000 |

|

Apply Credits |

$0 |

$30,000 |

|

Total Taxes Paid |

$17,500 |

($5,000)* |

*Carry over if it’s a non-refundable credit or get a check from the IRS if it’s refundable credit.

To claim credits on your tax return, you would have to complete the specific form related to the particular credit. You can find all the Internal Revenue Service forms for business tax credits on the IRS website.

8 LLC Tax Credits You Don’t Want to Miss

A professional accounting and bookkeeping consultation can help you efficiently apply for tax credits or deductions depending on your industry and business.

Additional Reading on LLC Tax Deductions

It’s important to understand the subtleties of what is and what isn’t considered a write-off. Below, we have expanded upon the most important categories that can qualify for deductions with their IRS-imposed limits and restrictions.

Self-Employment Tax

Self-employed individuals, including independent contractors, freelancers, and business owners, are responsible for paying both income and self-employment taxes on their income. However, if you’re self-employed, you can write off half of your self-employment tax as an income tax deduction.

Note: LLCs taxed as an S corp can save on self-employment taxes under the right circumstances. Visit our LLC vs S Corp guide or use our S corp calculator to see what's right for your small business.

IRS Reference: Topic 554: Self-Employment Tax

Startup Business Expenses

If you have $50,000 or less in startup costs and are in your first year of business, the IRS allows you to deduct $5,000 in startup costs and $5,000 in organization costs as a tex deduction.

If your startup expenses exceed $50,000, the total deduction will be reduced by however much your expenses exceed $50,000. For example, if your total startup expenses total $51,000, your allowed deduction will be $4,000.

This deduction does not apply if you have more than $55,000 in startup costs.

IRS Reference: Publication 535: Business Start-up and Organizational Costs

Office Supplies and Services

Generally speaking, office supplies refer to those that are used to run day-to-day office activities, such as papers, pens, sticky notes, ink, printing, postage, and delivery services.

Small business owners can deduct the entire office expense by using write-offs on the cost incurred on the incidental materials and supplies.

Tip: Use net 30 vendors for purchasing office supplies to help build business credit

IRS Reference: Publication 535: Supplies and Materials

Advertisements

Any expenses directed toward advertising, marketing, and/or promotions is a tax deduction. This includes but is not limited to logo creation, printing business cards, website updates, printing costs, and social media marketing. Some businesses also use large advertising mediums like billboards and television commercials.

IRS Reference: Publication 535: Advertising Expenses

Business Insurance

Business insurance includes any kind of protection required to run a business safely. Though the insurance varies based on business type, there are several premiums you could deduct, including those for property coverage, employee health insurance, general liability insurance, workers' compensation insurance, or professional liability insurance.

IRS Reference: Publication 535: Insurance

If your business isn't covered by insurance, it needs to be. Our review of the best small business insurance companies is a helpful resource.

Business Loan Interest and Bank Fees

You may be able to deduct interest charged on a business loan, including interest rates, monthly service fees, business banking overdraft costs, and payment processing fees. The IRS provides guidelines on what types of loan interest are considered deductible and what types are nondeductible.

Those with business credit cards can also deduct the convenience fees.

Tip: See our review of the best business credit cards to find an easy-approval secured or unsecured credit card for your small business.

IRS References: Publication 535: Interest You Can Deduct and Publication 535: Credit Card Convenience Fees

Education

Any educational courses or forms of training used to acquire new skills or certification for your business can be a tax deduction. This can include books and research materials that assist with professional development.

For the cost to be deductible, your education must be aimed at improving skills or maintaining your job, salary, or status. Any expenses used for the education and training of employees are also deductible.

IRS Reference: Publication 535: Education Expenses

Depreciation

The IRS describes depreciation as "an allowance for the wear and tear, deterioration, or obsolescence of the property." In other words, depreciation is a tax deduction that allows businesses to write off the value of certain tangible property over a period of time, typically throughout that property's "useful life."

If you use property partially for business use and partially for personal use, you can only deduct depreciation on the business usage. For example, if you purchase equipment for $20,000 and use it for business only 75% of the time, the business portion of that equipment's cost is only $15,000.

IRS Reference: Publication 946: How to Depreciate Property

Home Office Deduction

If your business operates out of your home, you can take advantage of the home office deduction that results from the cost incurred for business purposes. This includes rent, utilities, repairs, maintenance, cleaning, and any other expense associated with the office space.

You can compute your home office deduction by calculating the cost, multiplying by the area's square footage, and subtracting the value from the total. Alternatively, you can use the IRS simplified method, where you deduct $5 per square foot of office space for a maximum of 300 feet.

IRS Reference: Publication 535: Personal Versus Business Expenses

A professional accounting service can help you save money and time so you can focus on running your business. Hire a professional bookkeeper for a low monthly cost with Xendoo or do your own accounting with Freshbooks.

Legal and Professional Fees

Some legal and professional fees are considered deductible, including lawyers, bookkeepers, tax professionals, and accountants that you employ in order to operate your business.

IRS Reference: Publication 535: Legal and Professional Fees

Travel Business Expense

Self-employed people can write off certain travel expenses for their businesses, including but not limited to airfare, business meals, lodging, and local travel.

The IRS defines travel expenses as a business trip outside your tax home, overnight, and for business roles. That being said, there are some restrictions that are stipulated for international travel.

IRS Reference: Topic 511: Business Travel Expenses

Business Car Usage

A portion of the costs associated with business vehicles is deductible every tax year, including mileage and other operating costs for cars, trucks, and other commercial vehicles. If you use a vehicle for both business and personal usage, only the business costs will be eligible for tax deductions.

Companies can either use the standard mileage rate or actual car expenses for their business tax deductions. The standard mileage rate for business vehicle use is 57.5 cents per mile. Actual car expenses can include depreciation, licenses, gas, tolls, maintenance, lease payments, insurance, and parking fees.

IRS Reference: Publication 463: Car Expenses

Rent

Rent spent on office space (or the cost spent on space occupied by office equipment if you work from home) may be considered for tax deductions. Spaces that you rent out occasionally for work purposes can also be considered write-offs.

IRS Reference: Publication 535: Rent

Rented Equipment

Similar to the above, business equipment that is rented for certain small business services (e.g., construction equipment, power tools, etc.) can be considered a deduction. (Personal equipment is excluded from this deduction.)

Such equipment comes with additional costs, such as liability insurance and money spent on renting it. The insurance cost is meant to offer security to the equipment owner, and such costs are deductible to reduce business expenses.

Cost of Goods Sold

Businesses that buy products for resale or make products can deduct the cost of goods sold (COGS) from their gross receipts. COGS may include raw materials, labor, and supplies.

IRS Reference: Publication 535: Cost of Goods Sold

Retirement Contributions

LLC tax deductions may also cover a self-employed individual's retirement contributions. The total amount of the deduction will depend on the individual's retirement plan and their maximum contribution limits.

IRS Reference: Calculating Your Own Retirement-Plan Contribution and Deduction

Charity and Gifts

Charitable contributions in the form of cash payments are often deductible. Although, any charitable contributions made must be directly related to your business to be deductible. For example, a donation made to bring a business convention to your community would not be considered a charitable contribution.

All or part of the expenses used for business gifts can be deducted. That being said, the IRS implements a $25 deduction limit on every direct and indirect gift your business gives individuals throughout the tax year.

IRS References: Publication 535: Charitable Contributions and Publication 535: Gifts

Utilities

Any business-related expenses for utilities, including heat, electricity, telephone services, water, and sewerage, can be deducted. If you work from home, you cannot deduct basic telephone service; however, you can deduct the costs of long-distance business calls as well as the installation of a second, separate telephone line.

IRS Reference: Publication 535: Utilities

How to Minimize Your LLC’s Taxable Income

Self-employed business owners may face several tax burdens when starting their new business. Below are some saving techniques that could help maximize your profits at tax time.

Utilize Above-the-Line Deductions

Above-the-line deductions are the expenses used to calculate your adjusted gross income (AGI), which is then used for below-the-line deductions (i.e., most business expenses).

Above-the-line deductions can be calculated using Schedule 1 of your individual tax return and can include educator expenses, self-employed retirement plans, self-employed health insurance, and early withdrawal penalties.

Pay Taxes on Time

Self-employed individuals are mandated by the IRS to pay their designated taxes quarterly. Fail to comply, and you will be subjected to penalties and potentially high fines.

A paycheck calculator can be an effective starting point to execute timely tax payments., as it can help you discover the quarterly amount required to pay. In addition, it also helps you discover a deductible itemized list.

Save Funds for the Tax Season

Even if you already pay your required quarterly payments on time, it's good practice to set funds aside in a business bank account for tax filing. Even if you think that your tax payment will be the same as years prior, it's important to keep track of your business income so that you can account for any fluctuations.

In many cases, if you underpay the IRS for your quarterly taxes, you will not be penalized if you still paid 100% of what you paid the previous tax year. Still, some individuals, including those whose AGI was more than $150,000, have different thresholds.

Know What Taxes You Need to Pay

In addition to both federal and state income tax, you may also need to file a state-specific business tax. For example, some states levy a business privilege tax or franchise tax on certain business structures, including LLCs. These can be flat rates or dependent on your business’s profits.

Incorporate Your Business

If you operate your business as a sole proprietorship or a partnership, you can choose to incorporate it as an LLC or corporation. Not only will this move provide you with limited liability protection, but it will also provide you with unique tax benefits.

Outsource for Help

While you can research and complete your tax deductions yourself, using a professional service to help determine your business expenses can help ensure that you find the best write-offs for your business's activities.

Tax Write-Offs for LLCs: FAQ

What expenses can you write off as an LLC?

There is a long list of expenses that you can deduct as an LLC. Some of the main operating costs that can be deducted include startup costs, supplies, business taxes, office costs, salaries, travel costs, and rent costs. Your personal income tax cannot be considered a tax write-off.

Check out our LLC expenses cheat sheet to learn more.

What are tax credits?

A tax credit is an amount of money that taxpayers can subtract from the taxes they owe the government. There are two types of tax credits: refundable and nonrefundable. A refundable tax credit can be used to reduce the amount of taxes owed, and if the credit is more than the amount of taxes owed, taxpayers will receive a refund for the difference. A nonrefundable tax credit can only be used to reduce the amount of taxes owed; it cannot result in a refund.

Can an LLC write off food expenses?

Yes, food expenses are deemed deductible costs. This will only happen if the meals are with a business contact and aren't “lavish or extravagant.” You can cut 50% of the business meal costs or 100% based on the temporary 2021/2022 exception.

How do you write off a car as a business expense?

If you use your own car for business purposes, you can incorporate it as a business expense. In addition, if you lease a car for business use, you can indicate the percentage of business functions it serves for your business.

Can an LLC deduct expenses without an income?

There are certain thresholds that the IRS has put in place to determine whether you can deduct costs without earnings based on whether you have a true business or if it’s considered just a hobby.

Can you write off capital expenditures?

Unlike ordinary business expenses, the IRS doesn’t allow capital expenditures to be immediately deducted from a business's profits. Instead, they are gradually deducted from your business profit over the course of several years through amortization, or the depreciation of an asset’s value over a fixed period of time.

Are tax write-offs the same thing as a tax loophole?

No. A tax-write off is a business expense that can be deducted from your LLC's taxable income. An LLC tax loophole is a tax provision or an unforeseen impact from legislation that leads to tax savings for the filer. There are known tax loopholes in the US for LLCs but they are very rare— . mostly impacting a very small number of LLCs and often involving real estate acquisition.

There are, however, many opportunities for missed LLC tax-write offs.